What are commercial mortgages?

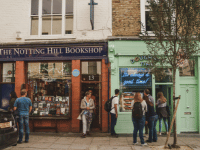

It is a loan used for buying or remortgaging business properties, such as offices, shops, salons, garages, or factories. These loans are also known as business mortgages.

Commercial mortgages are usually secured against a property, giving lenders security in case you are unable to repay. This can make lenders more flexible with their qualifying criteria, potentially improving your chances of approval.

Our team has helped many business owners get this type of finance, allowing them to achieve their goals. With our skills, products, and expertise, we are well-equipped to support you.

Solutions start from £30,000, with no upper limit on the maximum loan size. So, you may be able to get the funding needed to cover your plans.

Why choose a commercial mortgage?

Many landlords invest in business properties to diversify their portfolios. This is often because they can provide stable rental income with longer-term leases being available. Or, it could simply be because a great opportunity arises.

As a business owner, you might find yourself needing to buy a new property for various reasons, whether to expand your operations, move out of a rental space, or start a new venture. In these situations, you may need funding to help you achieve your goals. Commercial loans may be able to offer the financial support you need to buy the property and grow your business.

If you plan to buy the property to rent out to tenants, you'll need a commercial investment mortgage. However, if you intend to buy the property for your own business operations, you'll need an owner-occupied commercial mortgage.

To assist with buying or remortgaging these properties, working with a specialist broker or lender can be useful.

Types of commercial mortgages

There are two main types of business finance available:

- Commercial mortgages: Funding for properties used for business purposes, such as factories, offices, or garages.

- Semi-commercial mortgages: Loans for properties that combine residential and commercial elements. For example, a shop with flats above it that you plan to live in.

Although these finance solutions are similar, they can differ in terms of interest rates and conditions offered by lenders.

To understand the criteria and products you may be eligible for, it's useful to speak with a mortgage advisor. Our lenders offer both types of funding, so we may have a solution that fits your needs.

Get Started

Call us for FREE on 0800 032 4646 or enquire using the form below.

Don't forget – making an enquiry will not affect your credit rating in any way!

What can I use commercial mortgages for?

These loans can help you buy or remortgage a range of business properties, including:

- Warehouses and industrial units

- Retail outlets, restaurants, food chains, and public houses

- Day-care nurseries

- Single freehold units

- Holiday homes for investment purposes

- New residential complexes

- Portfolios of commercial properties

- Semi-commercial or mixed-use properties

Do I qualify for a commercial mortgage?

If you need to buy or remortgage a business property, you can apply. Eligibility will depend on the lender’s criteria.

Qualifying criteria vary by lender, so some may be more flexible than others. It’s important to research your options to find where you might be accepted.

Also, consider the property type when applying. If the property has both commercial and residential elements, you'll need a semi-commercial mortgage. For properties used solely for business purposes, a commercial mortgage is required.

Our team has in-depth knowledge of each lender’s criteria, making them experts at finding and arranging these solutions.

How much could I borrow?

Your lender will decide the size of your loan based on the funding you need and your personal circumstances.

We offer loans starting from £30,000 with no upper limit. However, to make sure you get a product that is affordable for you, the final loan amount will be based on your specific situation.

To get an estimate of what you might qualify for, apply online using the form above or give us a call.

How long can these loans last?

Repayment terms can vary based on the lender and your individual circumstances. However, both longer and shorter repayment periods are open to you.

As a commercial mortgage broker, we have access to a range of products with terms from 2 to 30 years. So, we may be able to find a solution tailored to your needs.

Risks of a commercial mortgage

While it can be a useful option, there are a few things to be aware of.

Firstly, they typically require a larger deposit compared to residential mortgages. This can be challenging for businesses with limited funds. It's good to shop around and prepare to save a larger deposit before applying.

Additionally, they may be harder to find, as it is a more complex area of lending. Therefore, you may need to use a specialist broker or lender.

Finally, because the loan is secured by the property, if you repeatedly fail to make payments, the lender could repossess the property to recover their costs.

By being aware of these issues when applying, you will be able to navigate them more confidently. Find out more in our blog ‘what to look out for when getting a commercial mortgage’.