What is bankruptcy?

Bankruptcy is an option you can use if you are facing unmanageable debts you cannot repay. It is a serious step that can have long-lasting consequences. However, it can also provide an opportunity to start over.

When you declare bankruptcy, your assets, such as your car, home and other valuable possessions, are sold to repay your debts. Any remaining debt is often written off, allowing you to have a fresh start. However, declaring bankruptcy can have a really negative impact on your credit rating. It can also affect your job prospects and may limit your ability to get finance in the future. Therefore, it is not something to enter into lightly.

Usually, you will be discharged from bankruptcy after a year. Bankruptcy is not suitable for everyone, and it is not the only way to deal with debt problems. So, it is important to seek advice from a debt advisor or charity who may be able to help you understand your options better.

Can I get a mortgage after bankruptcy?

When you’re discharged from bankruptcy, you may be able to get a mortgage. However, the process may be a lot more challenging and the terms may be less favourable.

Lenders may be more cautious when considering an application from someone who has been bankrupt in the past. This is because if you have been unable to pay back debt in the past, you may be at risk of doing the same in the future. Therefore, your options will be more limited and interest rates may be much higher.

However, it may still be possible with the right mortgage lender. It could be worth working with a specialist mortgage broker who may be able to help you access a lender that helps customers in this situation. Although this could be useful, using a broker may mean you have to pay extra fees, than if you went directly to a lender.

As a specialist mortgage broker, our experts are used to helping customers in this situation, so we may have a solution that could work for you.

Before you consider taking out a mortgage, it is vital you consider whether it is affordable for you. Taking on further debt is a huge decision that you should not enter into lightly, particularly if you have struggled to manage your finances in the past.

Things to consider before getting a mortgage after bankruptcy

Before applying for a mortgage after bankruptcy, there are a few key things to consider:

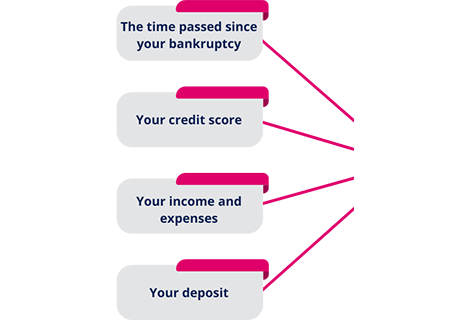

The majority of lenders will want a certain amount of time to have passed since your bankruptcy was discharged before they will consider your application. This could range from one to four years, depending on the lender.

Your credit score will have been impacted by your bankruptcy. Therefore, you should take steps to improve your credit score before applying for a mortgage, such as paying bills on time, paying off debts, and avoiding applying for credit unnecessarily.

Lenders will want to see evidence that you can afford the mortgage repayments. This is important, as if you default on your mortgage your home could be repossessed. You will need to provide evidence of your income and expenses, and it is vital you are realistic about what you can afford.

Additionally, lenders may require a larger deposit from someone who has been bankrupt. This is because they will want to reduce the amount they are lending to you to lower their risk.

How do I enquire?

Call us for FREE or enquire using the form below.

Don't forget – making an enquiry will not affect your credit rating in any way!

How do I apply?

Our initial enquiry process is quick. We’ve broken it down into 3 simple steps.

- Enquire: Call us to speak directly to an advisor, or use our online form above and we will call you.

- Leave it with us: Using our database, we will look through the different options we have available.

- Get your solution: If there is a good product available, we’ll call you to discuss it. Once we have discussed, it’s over to you to decide if you want to continue or not.

Make sure you are certain this is the right move for you and that you can afford it. The last thing anyone wants is for you to fall into the same difficulties again.

If you’re having trouble managing your finances, it's a good idea to reach out to your existing creditors for help. Additionally, you may want to speak with a debt charity, such as MoneyHelper or Citizens Advice Bureau (CAB), who may be able to offer you free advice.