The impact of late payments on your credit score

If you have had a history of late payments, you may be wondering if you can still get a mortgage. The short answer is yes, it may be possible. However, paying late can negatively affect your credit score, which may make it harder to get accepted.

A late payment will remain on your credit score for up to six years, so it could impact your ability to get finance for a while. However, the impact will diminish overtime, as long as you make future payments on time.

Some lenders are more relaxed with their criteria than others, so it is still possible to get accepted. Specialist lenders in particular take a more holistic view and try to understand the circumstances that may have caused you to pay late.

In addition, they may also take into consideration how late the payment is, the amount of money owed and if you have had multiple late payments.

Therefore, whilst it can be more challenging to get accepted, there are still solutions that could help you. However, the options may be more limited and you may be charged a higher interest rate to lower the risk for lenders.

We’re a specialist mortgage broker, who concentrates on supporting customers that are struggling to get accepted by the high street. So if you’ve been declined elsewhere, we may be able to help you.

Specialist mortgages for borrowers with late payments

Specialist mortgages are designed for borrowers who have complex financial circumstances; making it difficult for them to qualify for a traditional mortgage.

These solutions are offered by specialist lenders who usually have more flexible criteria. Sometimes it can be difficult to access these lenders on your own, so you may need to work with a broker. However, using a broker may mean there are extra fees than if you went straight to a lender.

Each lender will have different criteria, and you may find that some will accept you while others won’t. They will look at your credit score, but they will also consider other factors, such as your employment status, income and deposit.

You may find that these lenders require you to put down a larger deposit, or pay higher interest on your mortgage. This is because they will be trying to mitigate the risk of lending to someone who may have a higher chance of defaulting on their loan.

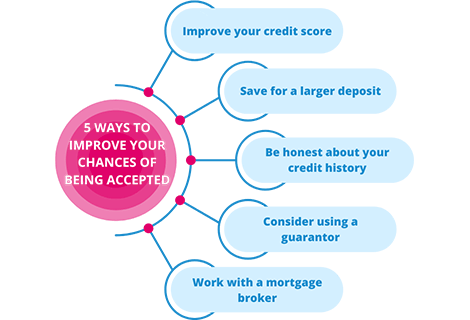

Improving your chances of getting a mortgage with late payments

If you have late payments on your credit file, you may find it difficult to qualify for a mortgage. However, there are steps you can take to try and improve your chances of getting approved.

Your credit score is one of the factors that a lender will consider when assessing your mortgage application. If you have a history of late payments, your credit score may have been badly impacted. Therefore, you should think about ways you could improve your credit score. This could include paying off debt, making future payments on time, keeping old credit accounts open, and registering for the electoral roll.

Another factor that can influence your application’s success is the size of your deposit. If you have a larger deposit, you will need to borrow less. This reduces the risks for lenders, meaning they may be happier about lending to you.

It’s good to be upfront about any financial issues you’ve had in the past, no matter how small or large. Lenders will complete a credit check as part of your application, so they will be able to see any issues you’ve had. If you can explain why a late payment occurred, you can help the lender understand your case better.

Finally, using a broker may improve your chance of success. Brokers have access to a range of different lenders, so they may be able to help you find lenders that are more willing to work with you. However, working with a broker will mean there are extra fees involved, compared to going directly to a lender.

How do I enquire?

Call us for FREE or enquire using the form below.

Don't forget – making an enquiry will not affect your credit rating in any way!

How do I apply for a mortgage with late payments?

If you are looking to get a mortgage and have a history of late payments, there may still be options available to you.

Our initial application process is fast. Plus, we are here to guide you every step of the way. Here's how it works:

1. Enquire: Call us to speak directly to an advisor, or use our online form above. You’ll need to answer some basic questions, so we get a clear understanding of your specific situation.

- It’s over to us: We will search our database of UK based lenders to find the best solutions we have available for your circumstances.

- Get your solution: If we find a suitable and affordable product, we’ll get in touch to talk you through it. Once we’ve talked it through, you decide whether you want to proceed. If you do, we can get the ball rolling on your application.

Before you take out a loan, it’s important to make sure you can comfortably afford the repayments. Otherwise, if you default on your mortgage, your property could be at risk of repossession.

If you’re struggling to manage your finances, it's a good idea to reach out to your current creditors for help. They may be able to offer support or arrange other repayment plans. It also could be worth speaking with a debt charity, such as MoneyHelper or Citizens Advice Bureau (CAB), who are able to offer you free support.