Can I get a mortgage with a low credit score?

Yes, you can get a mortgage with a low credit score. It may be more difficult than if you had a good credit record, but it is not impossible.

If you are accepted, you may be charged higher interest rates and may need to put down a larger deposit. Putting down a larger deposit could boost your chance of success, as it means you won’t have to borrow as much from the lender.

There are also steps you can take to show your lender you are a trustworthy borrower, such as paying off any debts you have and keeping on top of your monthly bills.

What is a low credit score?

Your credit score is a number that gives lenders an insight into your financial background. Lenders use this to determine how risky it would be to lend you money.

A low credit score may make any lender or creditor view you as a high-risk borrower, which can make it more difficult to get accepted for mortgages, loans, and credit cards. If you are accepted, you may find that you are offered less favourable terms, such as higher interest rates.

The three main credit rating agencies in the UK will use a number between 0 and 999. Ideally, you should try to aim for as high a score as possible. The higher your score, the better lenders will perceive you. Because of this, you could be more likely to get approved.

Each lender may have a different idea of what constitutes a poor credit score. Some may be more relaxed than others, so it’s worth shopping around to try and increase your chances.

There are many reasons you might have a low credit score. You might have missed a payment or paid a utility bill late, or you might have a short credit history. In more serious cases, you may have had to file for bankruptcy or had a County Court Judgement. All of these things will have a negative effect on your credit score. Even so, it may still be possible to get a mortgage with a ccj or get a mortgage after bankruptcy.

How does a low credit score affect your ability to get a mortgage?

Your credit score is one of the most important factors when applying for a mortgage because lenders use it to determine if they can trust you to repay the loan. Having a lower credit score may indicate that you are more likely to default on your mortgage payments. Therefore, many lenders might think it is a risk to lend to you.

Many mainstream lenders and high street banks may be unwilling to lend to you if you have poor credit. Therefore, your options may be more limited when it comes to finding a mortgage.

However, many specialist mortgage lenders provide mortgages to people with a low credit score, so they may have a solution for you.

We have helped many people with low credit scores get accepted for a mortgage, so we may be able to help you too!

How do I enquire?

Call us for FREE or enquire using the form below.

Don't forget – making an enquiry will not affect your credit rating in any way!

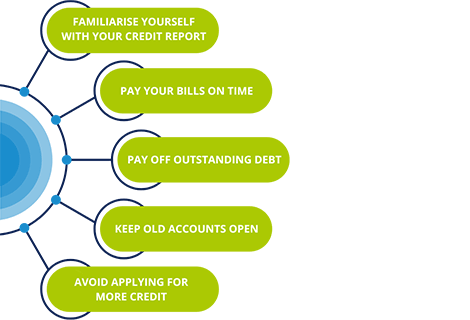

How to improve your credit score before getting a mortgage

Improving your credit score before applying for a mortgage can boost your chance of success. It may also allow you to access mortgages with more favourable terms.

The first thing you should do is check your credit score. If you find any mistakes or errors, you can contact a credit agency to rectify them.

Over time, you will start to rebuild your credit score if you make all payments on time, such as utility bills, mobile phone contracts and gym memberships. It also can help to show that you're more financially responsible to your lender.

Another component that is factored into your credit score is the length of your credit history. Having a longer history can be good for your score. Keeping old accounts open, even if you aren’t using them, may therefore be a good move for you to make.

It can take some time to improve your credit score, but doing so can massively help you when applying for a mortgage.

If you're having financial problems, it's a good idea to reach out to your current creditors for help. They may be able to offer support or arrange alternative repayment plans. For extra support, you could also contact MoneyHelper or Citizens Advice Bureau (CAB) who offer free advice.

How do I apply for a low credit mortgage?

As a specialist mortgage broker, we will always try to help you find the best possible solution.

Here’s our three step process:

Enquire: Call us to talk to one of our experienced team directly, or use our online form above.

It’s over to us: Once we have some initial details from you, we can start searching through our database of lenders to see if we have an option that is suitable.

Decision time: We will call you to discuss your solution if we find one that is suitable. Then we will leave it up to you to decide if you want to proceed or not. If you do, we will complete the final stages of the process.

Before you apply, make sure it is an affordable move for you. If you struggle to make repayments, you could further harm your credit score and lose your property (as the loan is secured against it).