What is a residential bridging loan?

A residential bridging loan is an option that helps people when they want to buy a new home, but they have not sold their current one yet.

It is a temporary solution that gives them money quickly, so they can get their new home while waiting for their old one to sell.

Normally, these loans last for a few months to a year. Some providers may allow longer than this, but our maximum term is 12 months.

These loans are secured against a property. This means should you default on your repayments; your home could be repossessed.

One of the most important aspects of this option is your exit strategy (your plan to repay the loan). Without having this clearly mapped out, you will struggle to be accepted.

If you are interested in this option, feel free to reach out to our team of knowledgeable experts who are ready to discuss your options at your convenience.

Initiating the process is as simple as enquiring in our online form above or giving us call, allowing us to handle the workload on your behalf.

What are the uses of a residential bridging loan?

These bridging loans can be helpful in certain situations such as:

Buying a new home: When you’ve found your dream home but haven't sold your current one, this option lets you purchase without delay. It means you do not have to be reliant on the sale of your old property. See how we helped a client use this option to secure a new home in our case study.

Fixing up your home: Say you want to renovate or make improvements to your property. With this funding solution, you can get the funds you need to make these changes before you sell or refinance your home.

Breaking property chains: Sometimes, things do not go as planned when you are buying or selling a home. If a buyer backs out at the last minute or there are delays, these loans can help you keep your property plans going smoothly. It is often known as chain break bridging.

Remember, it is important to talk to a financial advisor or a broker to see if a residential bridging loan is right for you. They can help you figure out if it is suitable for your situation and needs.

With over 35 years’ experience, our experts have the skills and knowledge needed to support you.

How do residential bridging loans work?

This funding solution works in a specific way. Here are the steps they usually follow:

Step 1: Applying for the loan - To get this option, you have to fill out an application form. You will need to provide information about your finances and the properties involved. The lender looks at things like how trustworthy you are with money, the value of the properties, and your exit strategy.

Step 2: Loan approval - If your application is accepted, the lender decides how much money they can lend you, the interest rate they will charge, and the rules for paying it back. They also set the duration of the loan, which is usually a few months to a year, but sometimes it can be longer.

Step 3: Getting the money - Once everything is approved, the lender gives you the loan. They might give it all at once or in smaller parts, depending on what you need and the terms.

Step 4: Completing the loan - When you sell your property or secure long-term financing, you use that money to pay back the loan, including any interest and fees. If it takes longer than expected, you might be able to get an extension, but that could cost extra.

If you are unsure about your options, contact our experts. As one of the longest running UK brokers, we will be able to quickly tell you whether it is a good solution for your needs.

Get Started

Call us for FREE or enquire using the form below.

Don't forget – making an enquiry will not affect your credit rating in any way!

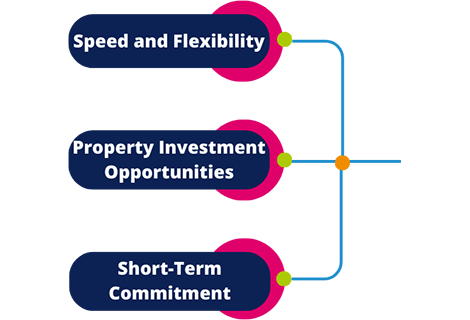

Benefits of residential bridging loans

Some benefits that make these loans a good choice for financing are:

Fast approval and funding: These options are known for being quick. They are approved fast, and you can get the money you need in no time. This helps a lot when you are in a hurry to buy a property or if time is running out.

Short-term and quick repayment: Unlike traditional mortgages that can take a long time to pay back, these options are short-term. This means you can repay them quickly once you sell your old property.

Flexible criteria - Since a property is used as security for the loan, lenders are usually more flexible with their requirements. This means your chances of approval may be increased and you may be able to get a bigger loan amount.

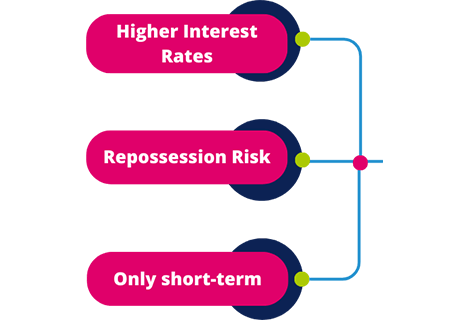

Disadvantages of residential bridging loans

As with all finance options there are some costs and risks you should be aware of. These are:

Higher interest rates: These loans usually have higher interest rates compared to other finance options. This is because they are short-term loans, which can be more risky for lenders.

Property at risk: Just like with other loans where you use your property as security, if you cannot repay your loan, the lender might repossess your property. This is why it is important to pay on time, to avoid the possibility of losing your home.

Short-term solution: These options are meant for short-term needs, not for long-term financing. If you cannot sell your old property or get long-term financing within the agreed loan period, you might run into problems.

It is crucial to talk to a financial advisor if you are considering this option. They can help you understand the risks and make sure you are making the best choices for your situation.

How to apply

It is easy to get in touch with our experts and make an enquiry. You can speak to an advisor by calling us.

If you prefer to email us or enquire using the form above, we will get back to you as soon as possible.

Once we receive your message, we will promptly get in touch with you to address your enquiry.